do you pay california state taxes if you live in nevada

Californias Franchise Tax Board administers the states income tax program. You do not have to be in your new state for 183 days just outside the former state for 183 days.

Moving To Nevada From California Retirebetternow Com

However even though you do not live in California you still must pay tax on income earned in California as a nonresident.

. 3 If you live in CA and work in CA then CA taxes all of your wage job income. Say you move from California to. This means that if you live in one state and work in another only one state can tax you.

You will have to pay California tax on your distributive share of the companys LLC income despite the LLC having earned all of its income outside of California say another state like NevadaThe second rule is that California will tax income generated in the state regardless of where you live. If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. I have no income in Illinois for 2021.

File With Confidence Today. If you move from California to Nevada this seems to avoid California state taxes in many instances. You will want to file the non-resident first and then your Nevada state return so that your state return can be calculated correctly against any credit from the non-resident CA state return.

While federal law prevents California and other states from taxing pension income of non-residents you may have to pay taxes on this income to. That means Californianspay substantially more property tax than Nevadians. As a part-year resident you pay tax on.

In Nevada there is no income tax imposed on S-corporations. Do you pay California state taxes if you live in Nevada. The state of California requires residents to pay personal income taxes but Nevada does not.

Or is the california tax prorated based on the number of months you lived in california. I moved from Illinois to Nevada June 30 th. For employees who move from California to a lower tax state like Nevada or Texas.

Do you pay California state taxes if you live in Nevada. Social Security retirement benefits are exempt but California has some of the highest sales taxes in the US. You will want to check your w2 for california incomewithholding and file what the company reported.

In California S-corporations are taxed at a rate of 15 on the net taxable income with the minimum tax being 800. The employer should be withholding california state income taxes from your wages. Answer Simple Questions About Your Life And We Do The Rest.

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. In California partnership LLCs pay a tax ranging from 1700 to almost 12000 per year depending on the. Yes you need to file a non-resident state return for the California income.

The state of California requires residents to pay personal income taxes but Nevada does not. Assume there is no Nevada location of the Company. As a part-year resident you pay tax on.

The short answer is. So if you own California real estate but live in New York you still have to pay. Do I pay California income tax if I live in Nevada.

About Us Trending Popular Contact. You do not have to be in your new state for 183 days just outside the former state for 183 days. It is true that in Nevada you do not pay tax on that income but California can tax you.

You may still have to pay income tax to more than one state but you cant be taxed twice on the same money. If you hold residency in California you typically must pay California income taxes even if. Income from California sources while you were a nonresident.

Do you pay California state taxes if you live in Nevada. In other words nonresidents pay California income taxes on taxable California-source income. Californias Franchise Tax Board administers the states income tax program.

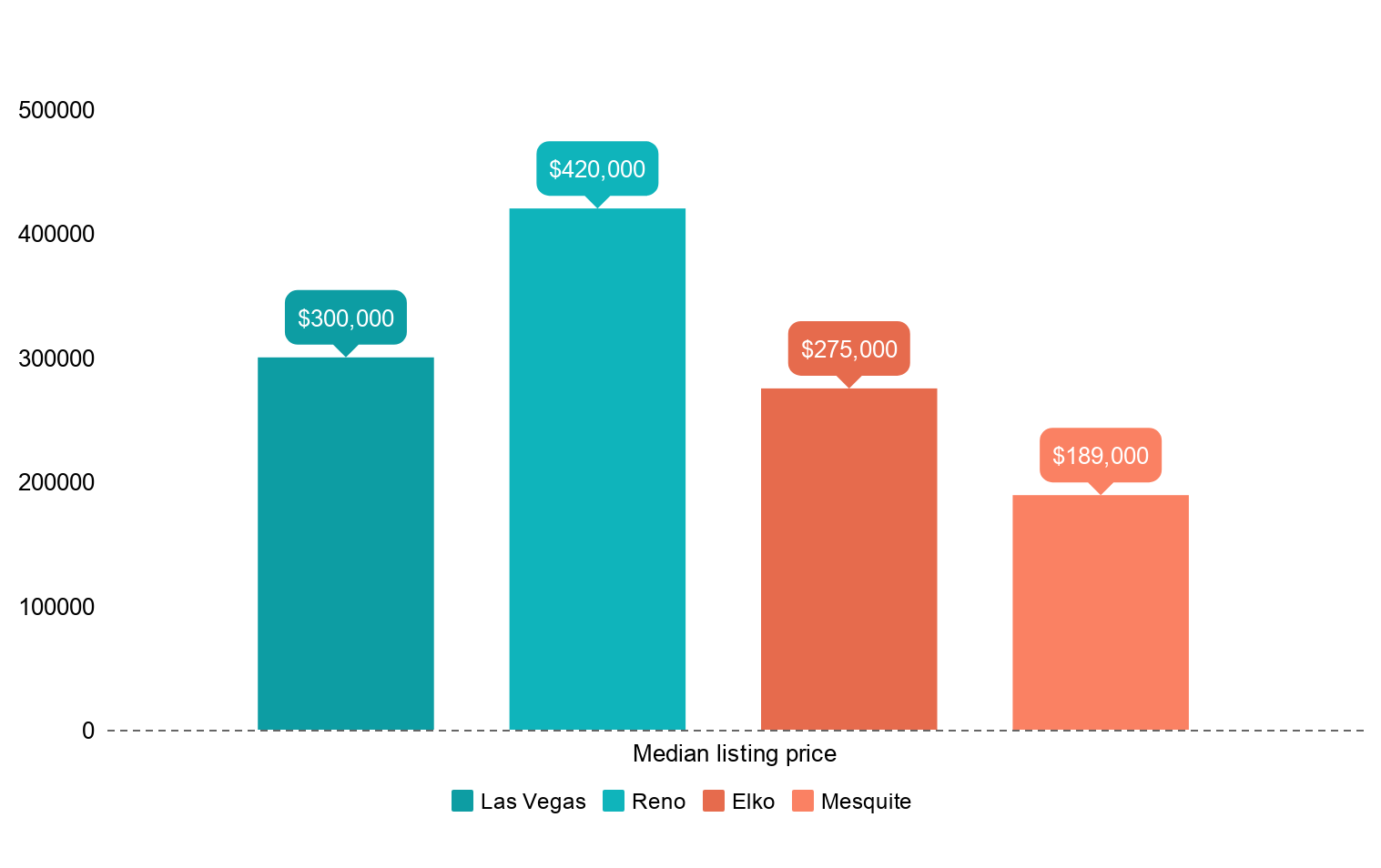

In Nevada there is no income tax imposed on C-corporations. Skip to content All About Incomes Questions and Answers All About Incomes Questions and Answers. In California the effective property tax rate is.

First the good news. Do you pay california state taxes if you live in nevada. The state of California requires residents to pay personal income taxes but Nevada does not.

79 and in Nevada its. I moved from Illinois to Nevada June Tax professional. All worldwide income received while a California resident.

Congress passed a law in 2015 that forbids double taxation. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. Californias Franchise Tax Board administers the states income tax program.

Can the state of California tax me on wages if I lived in Nevada all year. Therefore unless you have taxable income other than W-2 wage income such as stock sales earned interest dividends rental property income etc you can safely assume that CA will be taxing. The state of California requires residents to pay personal income taxes but Nevada does not.

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. With respect to employees the source of income from services compensated by W-2 wages is the location where the services are performed not the location of employer. After all Californias 133 tax on capital gains inspires plenty of tax moves.

All worldwide income received while a. If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. Even where California agrees that you moved they might not agree when you moved.

Do I have to pay California taxes if I live out of state. The state of California requires residents to pay personal income taxes but Nevada does not. If you lived inside or outside of California during the tax year you may be a part-year resident.

Say however you If you move from California to Nevada this seems to avoid Tax professional. If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of company do I have to pay California state taxes for 365 days or for just 65 days. 4 Only when you live in NV and work in NV does CA not tax your wage job income.

How long do you have to live in Nevada to be considered a resident. The state of California requires residents to pay personal income taxes but Nevada does not. Californias Franchise Tax Board administers the states income tax program.

Best Boomer Towns Best 21 U S Places For Retirement Nevada Reno Nevada Reno

There Are Actually A Few Areas To Choose From If You Want To Get In A Good Hike Or Escape The B Valley Of Fire Valley Of Fire State Park Valley

Pros And Cons Of Moving To Nevada From California

Pyramid Lake Nevada So Close To Reno Nevada Travel Travel California Camping

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Vs California Taxes Retirepedia

Lake Mead National Recreation Area In Nevada Arizona Nevada Travel Lake Mead California National Parks

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Mapsontheweb Minimum Wage Wage District Of Columbia

South Shore Lake Tahoe South Lake Tahoe Lake Tahoe Lake Tahoe Nevada

If I M Working For A Company In California And Live In Nevada What State Are My Paying Taxes To Quora

Travel Nevada Nevada Travel Nevada Trip

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Pros And Cons Of Moving To Nevada From California

Pros And Cons Of Moving To Nevada From California

Nevada Vs California Taxes Retirepedia

Get Ready To Pay Sales Tax On Amazon Amazon Sale Sales Tax Amazon Purchases

Pros And Cons Of Moving To Nevada From California

Moving From California To Nevada Or Arizona Which Is Better Rpa Wealth Management